THE federal government has released draft legislation on the reinsurance pool for cyclones and related flood damage which could bring down costs for Cape York residents.

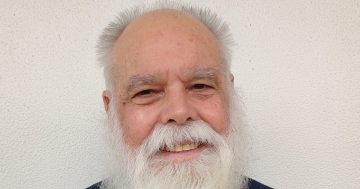

Member for Leichhardt Warren Entsch said it was the next step in delivering his government’s commitment to establishing a reinsurance pool that will support and protect hardworking people in northern Australia.

He said the government had listened to Far North Queenslanders and was taking strong and decisive action to help reduce their insurance costs.

Mr Entsch said following the public consultation period, legislation would be introduced into parliament in the first sitting weeks of 2022.

“The pool will improve the accessibility and affordability of insurance for households and small businesses in cyclone-prone areas across Australia,” the MP said.

“It is also expected to increase insurer participation in the Northern Australian market, increasing competition and putting further downward pressure on premiums.”

Mr Entsch said the reinsurance pool will be backed by a $10 billion government guarantee and commence on July 1, 2022 for residential, strata, and small business property insurance policies.

He said coverage for small business marine property insurance policies would be further developed and included from July, 2023.

“The reinsurance pool will be mandatory for insurers with eligible risks to participate in, with an 18-month transition period for large insurers and an extra 12 months for small insurers,” he said.

“Mandatory participation will ensure the reinsurance pool provides the greatest possible reduction in premiums.”

Mr Entsch said it would be a game-changer for families and businesses in Cape York.

He said it was anticipated more than 500,000 residential, strata and small business property insurance policies in northern Australia were expected to be eligible to be covered by the reinsurance pool.

“The high cost of insurance has been absolutely crippling to so many households and businesses,” he said.

“The Morrison government has listened, acted and is going to deliver real outcomes for Far North Queenslanders.”

To ensure the reinsurance pool is delivering for northern Australia, the government will provide $18.4 million over five years to the Australian Competition and Consumer Commission to monitor the premiums of insurance policies covered by the pool from 2022.

The ACCC will collect data to evaluate the impact of the reinsurance pool and assess whether the savings from the reinsurance pool are being passed through to policyholders.